What is an ICO?

Just as in the world of stocks there are IPOs, also in the world of cryptocurrencies, new projects raise funds through ICOs.

A crypto wallet is a computer program that allows you to store your cryptocurrencies.

There are 4 types of wallets, these are web wallets, software, hardware and paper wallets.

In this wallet, our public and private keys are stored, and those allow us to send and receive cryptocurrencies (such as Bitcoin and Ethereum) through the Blockchain.

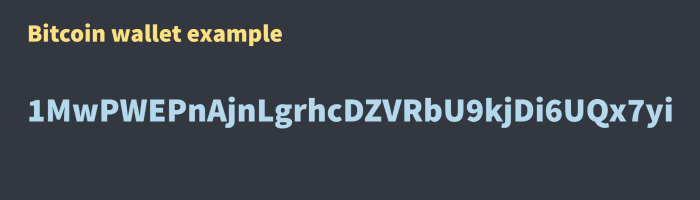

A wallet is identified as a set of 26 to 35 alphanumeric characters. This number identifies your wallet, to send or receive money to another wallet, just like your bank account number identifies you, to send or receive money between banks.

Fuente: El Canal de Shackra│Canal de YouTube │Adaptación del video original de weusecoins.com

It is important to clarify something technical before explaining how a wallet works. In reality, a crypto wallet does not store cryptocurrencies as something physical or virtual, but rather stores a public key and a private key.

Remember that the Blockchain is a database of transactions, and the wallets serve as a way of storing, through keys, who owns an amount of “X” cryptocurrency, meaning who has the rights to move that crypto through the Blockchain.

Your public key is like your bank account number or your email, since it identifies you in the public network of the Blockchain.

Your private key is like your bank PIN or your password, which you should never share with anyone, and it gives you the right to transfer or spend the cryptocurrencies assigned to your wallet address. The private key is a 256-bit number, and this makes it completely secure.

Do you want to know what a 256-bit number is? Click here.

The types of wallet are generally classified into two categories; Hot Wallets and Cold Wallets.

Hot wallets are those that are connected to the internet. These wallets are easy to create, access and manage.

An example is when you create an account at Coinbase or Binance and buy Bitcoin, the Bitcoin is deposited in a hot wallet, connected to the internet and protected by the security of the company and your own security mechanisms.

Hot wallets are classified in turn into 2 types; Web Wallets and Software Wallets.

Web Wallets are the most used worldwide by people who start investing in Bitcoin or other cryptocurrencies. These wallets are those that we automatically obtain when opening a new account on an exchange such as Coinbase, Binance, Kraken, Poloniex, among others.

Cryptocurrency and Blockchain experts criticize the use of this type of wallet, despite its popularity, since when we have a wallet in one of these popular cryptocurrency exchanges, we are not the owners of our private keys, but the exchange itself is the one who controls this key, keeps it and therefore we entrust our money to them.

This is called a “custodial” wallet, because we do not control our key, but rather it is safeguarded by a third party.

“Not your keys, not your coins.”

This saying is well known in the crypto community, and it responds to the previous point. The main risk of this type of wallet is that by not controlling your private keys (your secret key and main access and right to your cryptocurrencies), they are instead hosted on the company’s servers, and this is hacked, those private keys could be stolen, giving the person who carried out the attack, direct access to your money.

Are you worried after reading this? Don’t worry, the big and well established exchanges have high security protocols.

We invite you to read this article where we explain how to use the different types of crypto wallets to protect your money.

Software wallets are computer programs that are installed directly on your PC or mobile device. In this case, the private keys are stored directly on your computer or smartphone.

This type is called a “non-custodial” or “self-custody” wallet, since you have sole control of your private keys.

It is considered a safer storage method for your cryptocurrencies than web wallets, since the security of your investment depends only on you.

It is important to mention that there is always a latent risk, because if your computer or device is hacked by someone, through malware or virus, that person could have access to your keys, and therefore to your money.

If someone was to steal your device, but you had a strong login password, and also a PIN or biometric sign in to the program or app, you will be much safer.

What if my computer or mobile device dies? Do I lose my cryptocurrencies? We recommend that you read this article.

Cold wallets are storage mechanisms or devices that are offline, that is, they are not connected to the internet.

They are considered the safest mechanism to store your cryptos, since not only are you the absolute owner of your private keys, meaning, they are non-custodial wallets, but at the same time, there is no way that a hacker can access them.

The only way you can lose your cryptocurrencies is if someone physically steals your wallet and has access to your seed phrase.

The seed phrase is a set of 12 or 24 words, randomly generated each time that a new non-custodial wallet is created.

These words make you the absolute owner of the coins in that wallet.

These words are your money, therefore you should never, ever share them with anyone who you do not want to have absolute access to your cryptocurrencies.

If something happens to the device where your cryptos are stored, you can regain access to them by using this seed phrase, which gives you back access to your public and private keys.

Cold wallets are classified in turn into 2 types; Paper Wallets and Hardware Wallets.

Paper wallets are a mechanism for storing the public and private keys of your crypto wallet, on a piece of paper, literally.

Basically this type of wallet is a printed document that contains a public address where cryptocurrencies can be sent to, and a private key. This information is what you will need if you want to move your money from one place to another within the Blockchain.

The best way to operate with this type of wallets is by using QR codes, to be able to scan them and carry out transactions. This prevents you from having to manually type wallet addresses and likely make mistakes, which would in turn make you lose your crypto.

You can generate a paper wallet with services such as BitAddress or Bitcoinpaperwallet, that allow you to create a random wallet address, with its own private key. Then you will have to print the generated document and come up with the necessary security measures for your paper.

Hardware Wallets are electronic devices that store your private keys, and at the same time, are completely disconnected from the internet.

Many look like a USB device, sometimes with a small screen, and newer ones, are bigger like a smartphone, including a touch screen.

The most recognized brands on the market today are; Ledger and Trezor, but there are as well other brands that are gaining much popularity.

These hardware wallets have a great advantage over paper wallets. This is because they have a security chip that prevents your private keys from being entered into a computer. To operate with your coins you will simply have to enter a PIN code on the Wallet.

Most of them have a computer or smartphone application for ease of use, but the way the best hardware wallets are built, makes that your keys never leave your device, thus protecting your money.

In addition, if it happens that your wallet is lost, the device dies, or is damaged by water or fire, you can restore access to your cryptocurrencies with a new device of the same brand or similar brand, by using the keywords or seed phrase, that your create at the beginning, when you configure the wallet for the first time.

The keywords or seed phrase are the only way to regain access to your coins. You must protect this information with the highest physical security standards you can.

As you can see, this type of crypto wallet is the safest way to store your cryptocurrencies, but the biggest drawback is the high market price for some of them. Over the years, the competition will continue to grow, and therefore, prices will become affordable for most.

If we had to point out a weakness of these wallets, it would be the need to store the seed in a safe place, since if you lose that series of words, your investment would be gone forever.

If you are new to the world of cryptocurrencies, and want to open a wallet to make your first investment, we recommend you navigate to our Tutorials page, and follow our friendly and personalized tutorial step by step: Open your first wallet and buy Bitcoin, all lead by Michibit, your crypto kitty friend.

Just as in the world of stocks there are IPOs, also in the world of cryptocurrencies, new projects raise funds through ICOs.

Is the metaverse the future? From Mark Zuckerberg changing the name of Facebook to Meta, to games that generate various incomes for their users, the metaverse seems to be the future of how we interact with each other.