What is the Blockchain?

Blockchain is the technology behind Bitcoin, Ethereum and other cryptocurrencies.

The Blockchain is the platform for the decentralized projects of the future.

Bitcoin (BTC) is a digital currency. Meaning, it is not physical money, there are no bills, nor coins, as it was created on computers and is mobilized over the internet.

For many, it is the perfect currency, since its operation depends only on mathematics and high technology such as computers and the global internet network, that is, we remove from the equation who can compromise the system, us, humans.

Again, it is not physical money, and the currency that we know with the “B” is just a logo.

Its creation, distribution, exchange and storage is possible through the use of a decentralized accounting system, known as Blockchain.

Do you want to know what the Blockchain is? Click here.

Fuente: El Canal de Shackra│Canal de YouTube │Adaptación del video original de weusecoins.com

Bitcoin was created as open source software, first proposed in 2008 by an anonymous programmer, or perhaps a group of developers (as no one really knows up to date), under the pseudonym Satoshi Nakamoto.

In the midst of the biggest economic crisis since the great depression, this anonymous person offered a digital payment system with much lower transactions than the traditional system, and that would not be controlled by any central government. Instead, it would be operated by the network itself (the Blockchain), in a decentralized and secure way, thanks to cryptography.

We explain to you what cryptography consists of. Click here.

Satoshi Nakamoto’s original email was first published on October 31, 2008, on a crypto network mailing list. The email read:

“I have been working on a new electronic cash system that is totally peer-to-peer, without a trusted middleman.”

In simple terms, Bitcoin is a payment system, because after all, our societies and lives work because we exchange goods and services through a payment system.

There already are large-scale payment systems, such as the dollar, but those are controlled by central governments, which decide what happens to money.

After that, to make transactions, we must be members of a bank, accept their policies, pay transaction costs, usually high, and expose our finances.

Bitcoin was the opportunity to eliminate the bank, that is, the intermediary. So “Carlos” in the United States, could pass money to his friend in Japan, directly, without questions, and at minimal cost. The transaction would take 10 minutes on average to complete, despite the distance. Not a bad idea after all, right?

How could this be possible? The Network.

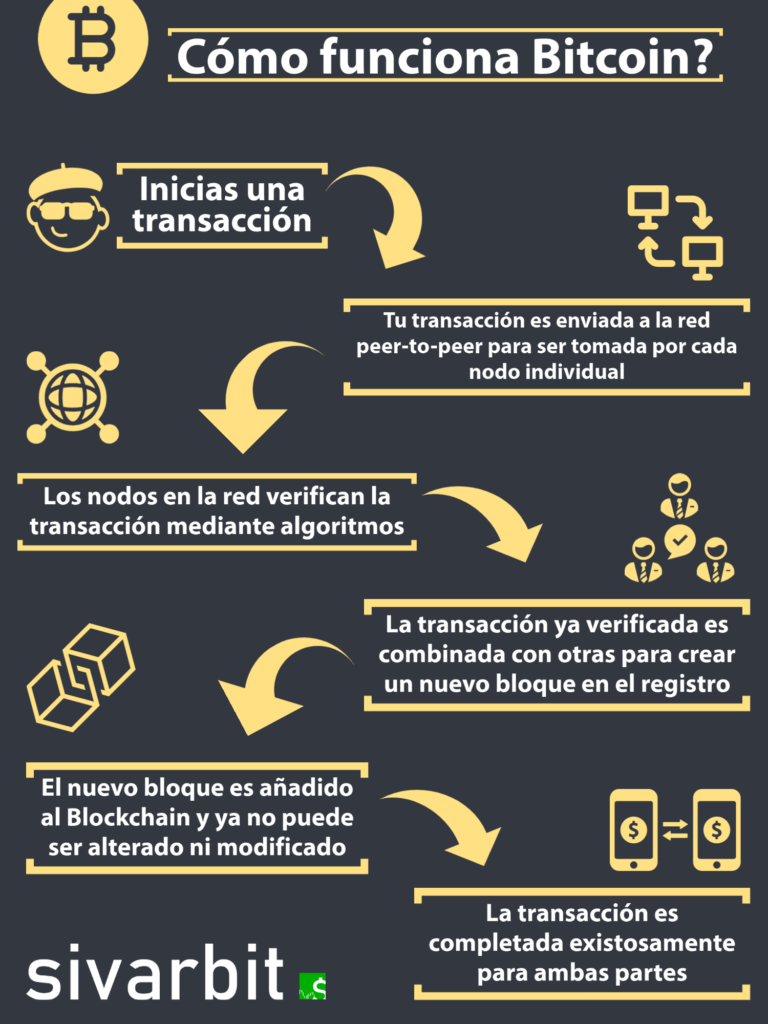

Satoshi Nakamoto created a global financial system, which is made up of thousands of computers that verify transactions (replacing bank systems), and in exchange, they are rewarded with Bitcoin, the currency itself.

The Bitcoin network is sharing the “Public Ledger”, or Blockchain, at all times, and each node or miner (computer in the network) has an equal copy of the transaction book, therefore no one can fool the system.

The miners are the computers on the network. Each computer must use its operating power to mathematically verify many transactions and thus discover a new block that will be added to the network, and if this is done, it receives Bitcoin as a reward.

The reward has changed over time. It started as 50 Bitcoins in 2009, and as of May 2020, it was only 6.25 Bitcoins, but likewise the value of Bitcoin has multiplied, keeping the network encouraged.

Peer-to-peer technology, refers to the direct exchange of some asset, such as a digital currency, between individual parties without the participation of a central authority. A strictly peer-to-peer currency exchange system was the main goal that drove the creation of Bitcoin, the most widely used cryptocurrency.

Satoshi Nakamoto published a whitepaper called “Bitcoin: A Peer-to-Peer Electronic Cash System,” on an internet crypto forum.

The electronic Bitcoin network goes live and sends 10 Bitcoin to Hal Finney.

Bitcoin begins to be bought and sold in exchanges, at a price of $ 0.0008.

The price of Bitcoin reaches $1 and then rises up to $31.

Bitcoin reaches a value of $1,242.

The price of bitcoin is very volatile and remains below $1,000.

Bitcoin rises back to $1,000 and all the way up to $20,000.

The price collapses to $3000, losing 85% of its value.

Bitcoin price climbs back to $10,000 per coin.

Bitcoin hits the price of $20,000 again after 3 years.

Bitcoin rises to an all-time high of $65,000.

For many, Bitcoin is an asset that stores value, and a way to hedge against inflation. It has already been called the gold 2.0 many times.

For others, Bitcoin is the perfect monetary system, and should replace currencies like the dollar or the euro.

Bitcoin might as well be each of the above, all or none. Throughout history, human beings have given a lot of value to what they consider unique, scarce and useful, and without a doubt, Bitcoin fulfills all three characteristics perfectly.

Despite having been created 14 years ago, it is still too early to determine what the true value of Bitcoin will be, but without a doubt it was and continues to be a necessary revolution, and one that is here to stay.

It is difficult to know what the future holds for Bitcoin, since its price is moved by speculation, but it is undoubtedly being increasingly accepted and accumulated around the world.

In October 2021, the first ETF (Investment Fund) was launched in the United States. Elon Musk reveals again that he owns more than 1 trillion worth of Bitcoin and other cryptocurrencies, and a day later Anthony Scaramucci, a prominent US financier reveals the same.

One month earlier, September 2021 and El Salvador became the first country in the world to legalize Bitcoin as an official circulation currency, sparking discussion from other Latin nations to follow the same path.

Without a doubt, Bitcoin has generated a lot of positive and negative discussion since its creation in 2008, but this is what usually happens when a new revolutionary technology is born, because not everyone is ready for change so quickly, and there are others who want to defend their economic interests among all. There will undoubtedly be governments like El Salvador that will open their doors to Bitcoin and others that will not, and will find a way to regulate it. Only time will tell.

What is clear is that there are already many people and institutions that are accumulating Bitcoin as part of their wealth, so as not to be left without a piece of the cake.

If you want to learn how to buy Bitcoin reliably and safely, you can follow our personalized tutorial here.

Blockchain is the technology behind Bitcoin, Ethereum and other cryptocurrencies.

The Blockchain is the platform for the decentralized projects of the future.

There are different types of crypto wallets and these are the ones that give us access to our cryptocurrencies or virtual properties.